What is Compound Interest?

Compound interest is a concept in finance that refers to the interest earned on both the initial amount of money deposited or invested, as well as the accumulated interest from previous periods. It is a powerful tool that allows investments to grow exponentially over time.

How Does Compound Interest Work?

When you invest or deposit money in an account that offers compound interest, the interest is calculated based on the total amount of money in the account, including any interest that has already been earned. This means that over time, the interest earned becomes part of the principal amount, and subsequently earns interest itself.

For example, let’s say you invest $1,000 in an account with an annual interest rate of 5%. After the first year, you would earn $50 in interest, bringing the total amount in the account to $1,050. In the second year, the interest would be calculated based on $1,050, resulting in $52.50 of interest. As each year passes, the interest earned continues to increase, leading to even greater returns in the long run.

The Power of Compound Interest

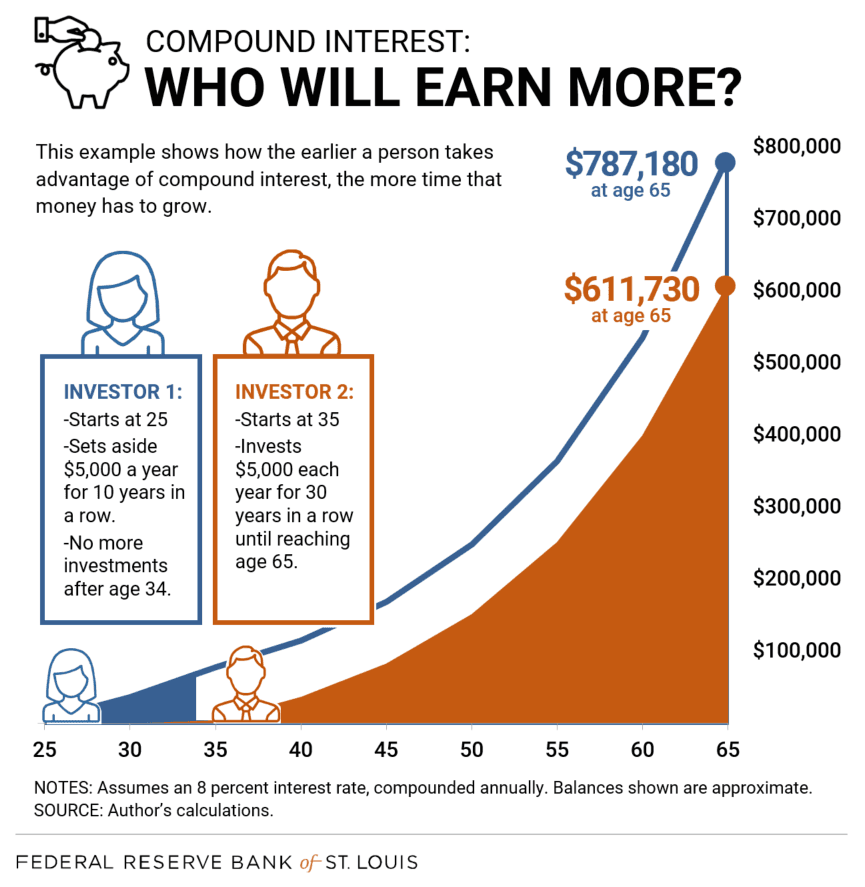

Compound interest has a compounding effect that can significantly boost the growth of your investments over time. The longer you leave your money invested, the more powerful the effects of compound interest become. This is why it is important to start investing as early as possible.

By harnessing the power of compound interest, individuals can build wealth and achieve their financial goals. It allows your money to work for you, generating passive income and increasing your overall net worth.

Conclusion

Understanding compound interest is essential for anyone looking to make smart financial decisions. By taking advantage of compound interest, you can make your money work harder for you, leading to greater financial security and prosperity in the long run.