Charitable Giving and Financial Planning

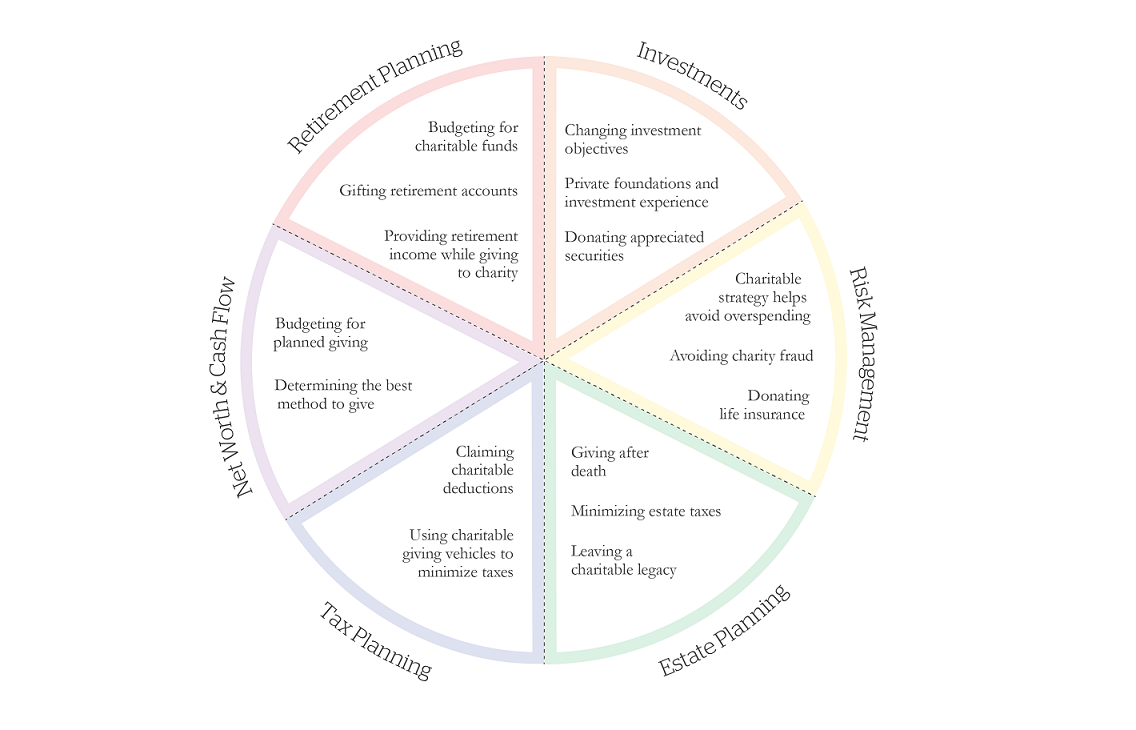

When it comes to financial planning, one important aspect that often gets overlooked is charitable giving. Many people focus solely on saving and investing for their own future, but incorporating charitable giving into your financial plan can bring about a sense of fulfillment and make a positive impact on the community.

Why Include Charitable Giving in Your Financial Plan?

Charitable giving allows you to support causes and organizations that align with your values and beliefs. It can provide a sense of purpose and fulfillment beyond financial success. By incorporating charitable giving into your financial plan, you can make a difference in the lives of others and leave a lasting legacy.

Strategies for Charitable Giving

There are several strategies you can employ to incorporate charitable giving into your financial plan:

- Donor-Advised Funds (DAFs): DAFs allow you to make a tax-deductible donation to a fund and then recommend grants to specific charities over time. This strategy allows you to take an immediate tax deduction while having the flexibility to distribute funds to charities at a later date.

- Charitable Trusts: Charitable trusts allow you to donate assets to a trust, receive a tax deduction, and designate a beneficiary to receive income from the trust for a certain period. This strategy can be beneficial for individuals who want to provide for both charitable causes and loved ones.

- Legacy Giving: Legacy giving involves including charitable donations in your estate plan. This can be done through a will, trust, or beneficiary designation. By leaving a portion of your assets to charity, you can support causes you care about even after you’re gone.

Benefits of Charitable Giving

Aside from the personal fulfillment that comes with giving back, there are also financial benefits to incorporating charitable giving into your financial plan. Charitable donations are generally tax-deductible, which can help reduce your taxable income. Additionally, donating appreciated assets can provide significant tax advantages by avoiding capital gains tax.

Moreover, charitable giving can also serve as a valuable teaching opportunity for future generations. By involving your children or grandchildren in the process, you can instill the importance of philanthropy and create a lasting family tradition of giving back.

Conclusion

While financial planning often focuses on individual goals, it’s essential to consider the impact you can have on others through charitable giving. By incorporating charitable giving strategies into your financial plan, you can make a positive difference in the world while also reaping personal and financial benefits. Remember, it’s not just about accumulating wealth; it’s about using that wealth to create a meaningful impact.