Importance of Healthcare and Financial Planning

Healthcare and financial planning are two crucial aspects of life that require careful consideration and proactive decision-making. While the two may seem unrelated, they are interconnected in various ways, and both play a significant role in ensuring a secure and stress-free future.

Healthcare Planning

Healthcare planning involves making informed decisions about your healthcare needs, including insurance coverage, preventive measures, and long-term care options. It aims to safeguard your physical and mental well-being, ensuring access to quality healthcare services when needed.

Proactive healthcare planning can help individuals and families avoid unexpected medical expenses and protect their financial stability. It involves assessing health risks, understanding insurance options, and creating a budget for healthcare expenses. By staying on top of preventive care and having adequate coverage, individuals can minimize the financial burden associated with medical emergencies or chronic illnesses.

Financial Planning

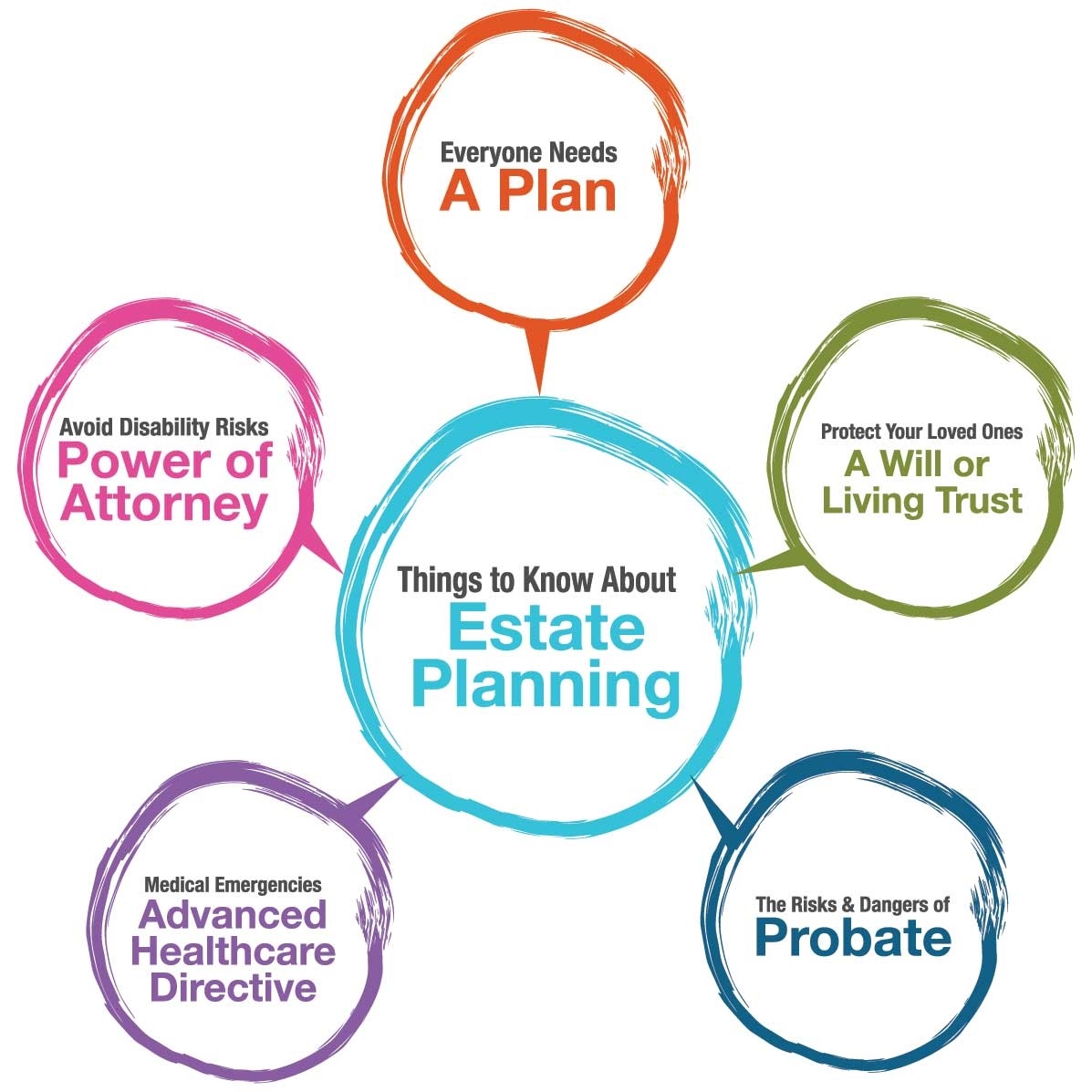

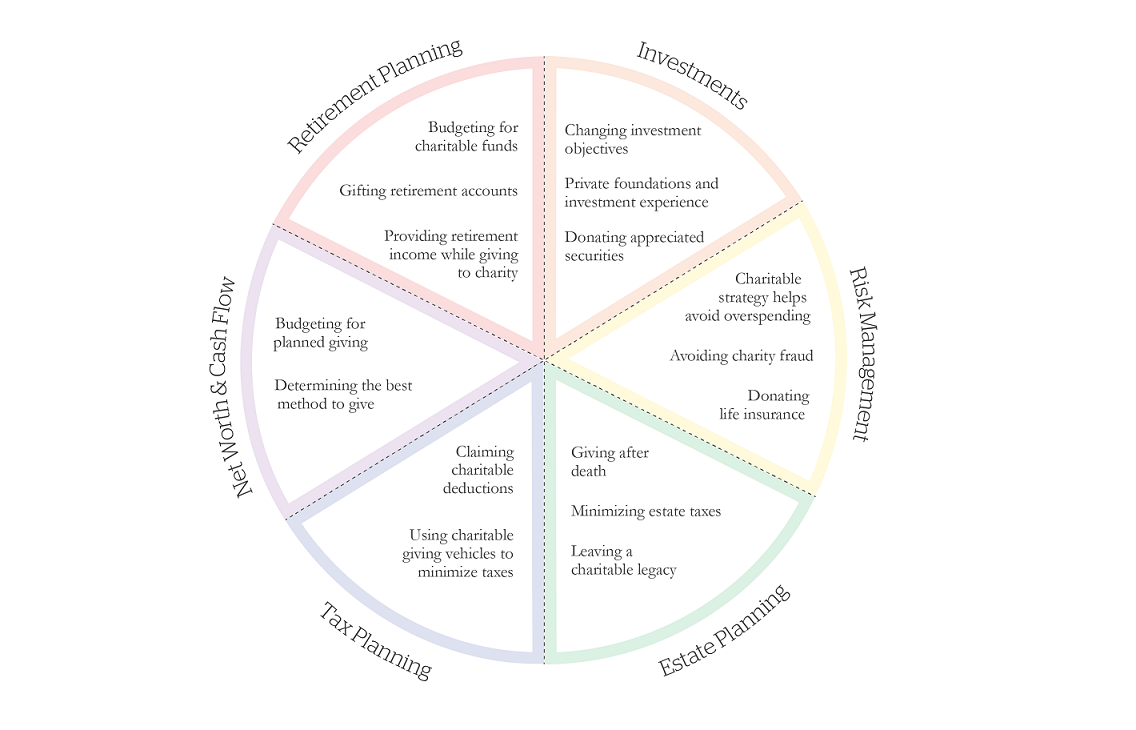

Financial planning, on the other hand, focuses on managing and growing your financial resources to meet short-term and long-term goals. It involves budgeting, saving, investing, and managing debt effectively. A well-thought-out financial plan can provide financial security and peace of mind.

Integrating healthcare planning into your financial plan is essential. Unexpected medical expenses can significantly impact your financial well-being if you are unprepared. By incorporating healthcare costs into your budget and considering insurance options, you can better manage these expenses and protect your financial goals.

The Interconnection

Healthcare and financial planning are interconnected in several ways. A healthy individual can better focus on their financial goals and make informed financial decisions. On the other hand, financial stability allows individuals to afford proper healthcare without compromising their financial well-being.

Moreover, healthcare expenses can be a significant financial burden, especially during emergencies or in old age. A comprehensive financial plan that accounts for healthcare costs can help individuals better prepare for these situations and minimize the impact on their savings or retirement funds.

Conclusion

In conclusion, healthcare and financial planning are crucial for a secure and stress-free future. By proactively planning for healthcare needs and incorporating them into a comprehensive financial plan, individuals can protect their physical well-being and financial stability. It is essential to make informed decisions, stay on top of preventive care, consider insurance options, and regularly review and adjust the financial plan to ensure it aligns with changing healthcare needs and goals.