Financial Literacy for Kids

Introduction

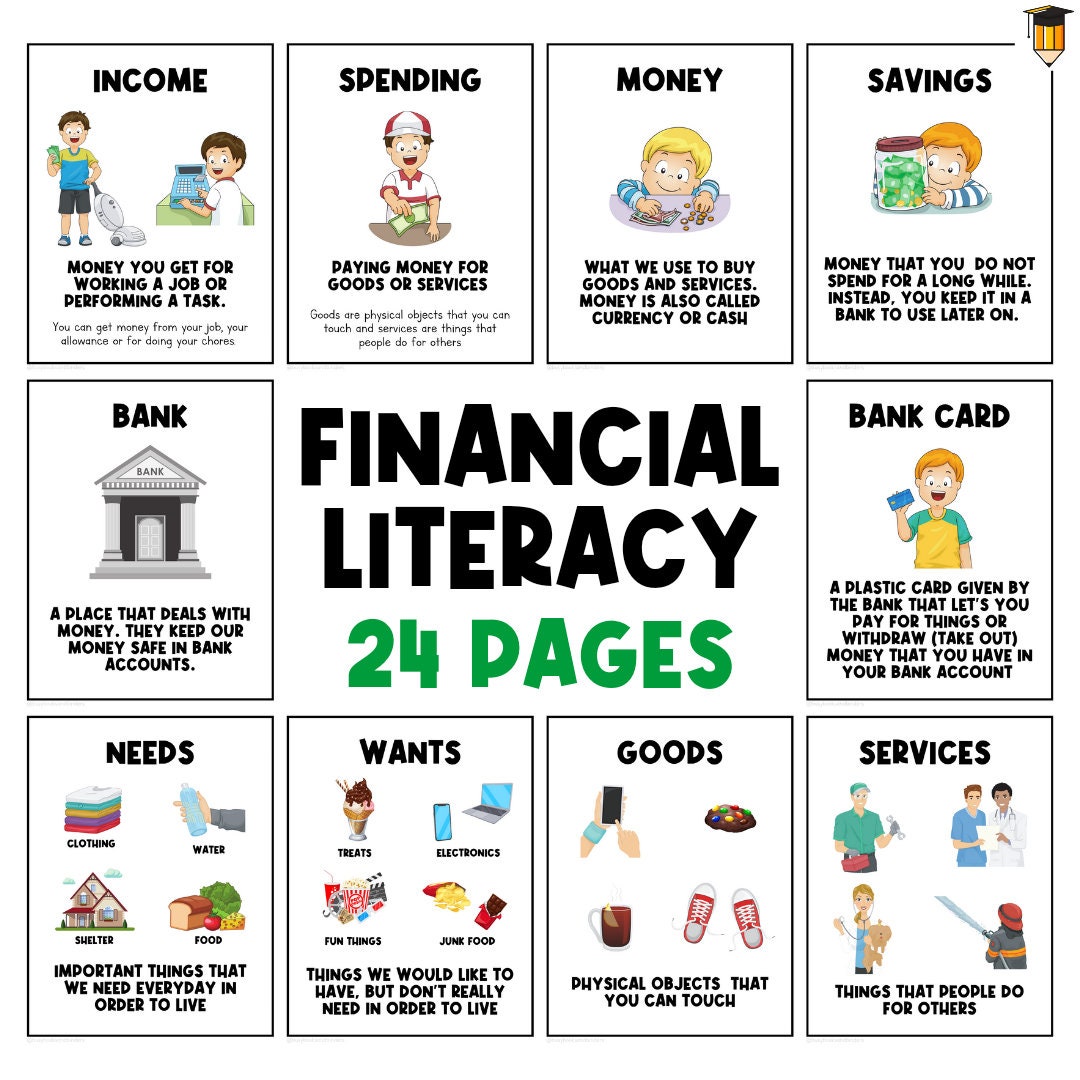

Teaching financial literacy to kids is becoming increasingly important in today’s world. It is essential for children to develop a strong understanding of money management from an early age. By introducing basic financial concepts to children, parents and educators can empower them to make informed decisions about money in the future.

The Importance of Financial Literacy

Financial literacy equips kids with the knowledge and skills they need to handle money responsibly. It helps them develop a positive attitude towards saving, budgeting, and investing. By teaching children about the value of money and the importance of making wise financial choices, we can set them on the path to financial success.

Teaching Financial Literacy

There are various ways to teach financial literacy to kids. One effective method is through hands-on experiences. Parents can give children a small allowance and encourage them to save a portion of it. This helps them understand the concept of budgeting and delayed gratification.

Another approach is to use games and activities that make learning about money fun. Board games like Monopoly or online resources such as interactive websites can engage children in financial decision-making scenarios.

Integrating Financial Literacy into Education

Schools play a vital role in promoting financial literacy. By incorporating financial education into the curriculum, educators can ensure that children receive a comprehensive understanding of money management. This can be done through dedicated courses or by integrating financial concepts into existing subjects like math or economics.

Additionally, guest speakers from the financial industry can be invited to share their knowledge and experiences, providing real-world insights to students.

Conclusion

Financial literacy for kids is a critical skill that should be taught early on. By equipping children with the necessary knowledge and skills to make sound financial decisions, we empower them to achieve financial independence and success in the future.