The Importance of Saving for the Future

When it comes to personal finance, saving plays a crucial role in achieving financial stability and reaching long-term goals. The psychology of saving is fascinating as it involves understanding the underlying motivations and behaviors that drive individuals to save money for the future.

The Role of Delayed Gratification

One of the key psychological factors driving saving behavior is the concept of delayed gratification. This refers to the ability to resist immediate temptations and instead opt for long-term rewards. People who possess this trait are more likely to save money as they prioritize their future financial well-being over short-term desires.

Research has shown that individuals who practice delayed gratification tend to have higher savings rates and are better prepared for unexpected financial emergencies. This mindset allows them to focus on their long-term financial goals and make necessary sacrifices to achieve them.

The Influence of Behavioral Economics

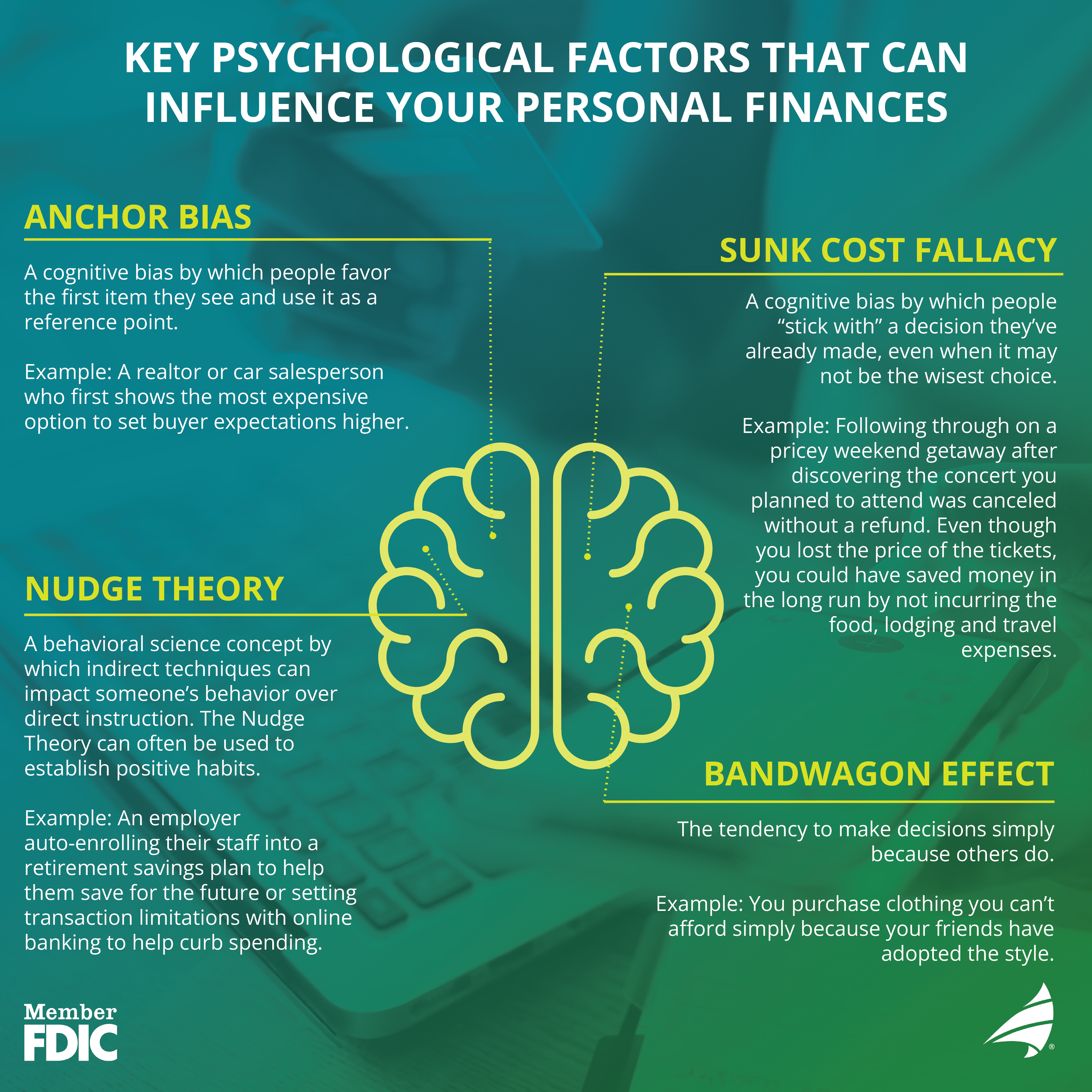

Behavioral economics studies the effects of psychological, cognitive, and emotional factors on economic decisions. It provides valuable insights into the psychology of saving by highlighting how people’s behaviors and biases impact their saving habits.

For example, the scarcity bias can lead individuals to save more when they perceive resources as limited or scarce. Similarly, the herd mentality can influence people to save if they see others around them doing the same.

The Power of Automatic Savings

Another psychological strategy that promotes saving is automatic savings. This involves setting up automatic transfers from one’s paycheck or bank account into a savings or investment account. By automating the saving process, individuals remove the temptation to spend money before saving it.

The Role of Goal Setting

Setting specific and achievable financial goals is an effective way to motivate saving behavior. When people have a clear target they are working towards, it becomes easier to resist impulsive spending and divert funds towards savings instead.

Additionally, breaking down larger goals into smaller milestones provides a sense of accomplishment along the way, reinforcing positive saving habits.

The Impact of Social Norms and Peer Pressure

Social norms and peer pressure can significantly influence saving behavior. If an individual’s social circle values saving and practices frugality, they are more likely to adopt similar habits. On the other hand, if their peers encourage excessive spending and instant gratification, it can hinder saving efforts.

By understanding the psychology of saving and the impact of social influences, individuals can make conscious choices to surround themselves with like-minded individuals who prioritize saving for the future.

Conclusion

The psychology of saving encompasses various factors that drive individuals to save money for the future. From delayed gratification to behavioral economics, automatic savings, goal setting, and social influences, understanding these psychological aspects can empower individuals to develop effective saving habits and achieve their long-term financial goals.