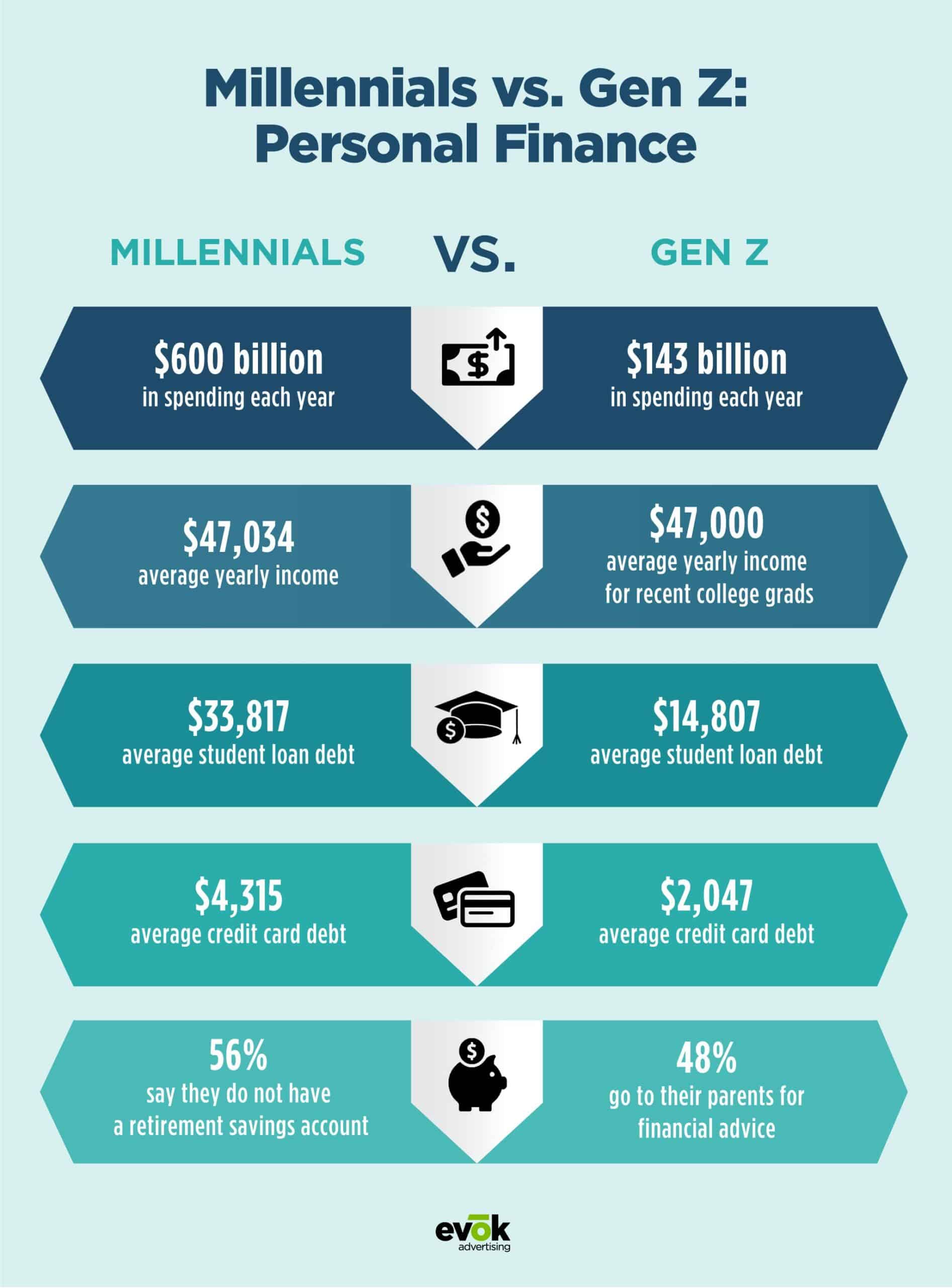

Savings Tips for Millennials/Gen Z

Being financially responsible is essential for everyone, especially for millennials and Gen Z. Saving money can help secure a better future and provide financial stability. Here are some valuable tips to help young adults save effectively:

1. Create a Budget

Start by analyzing your income and expenses. Make a list of all your monthly expenses, including bills, rent, groceries, and entertainment. Compare it to your income and see where you can make adjustments. Creating a budget will help you prioritize your spending and identify areas where you can cut back.

2. Set Clear Savings Goals

Having a goal in mind can motivate you to save. Whether it’s saving for a down payment on a house or building an emergency fund, set clear goals and track your progress. Break them down into smaller milestones, and celebrate each achievement along the way.

3. Automate Your Savings

Set up an automatic transfer from your checking account to your savings account each month. By automating your savings, you won’t have to rely on your willpower to save. Treat it like any other bill payment, and you’ll gradually build up your savings without even noticing.

4. Minimize Debt

Avoid accumulating unnecessary debt. If you have student loans or credit card debt, make a plan to pay them off as soon as possible. High-interest rates can eat away at your savings, so focus on eliminating debt to free up more money for saving.

5. Cut Back on Unnecessary Expenses

Take a critical look at your spending habits and identify areas where you can cut back. Consider cooking at home instead of eating out, cancel unused subscriptions, and find free or cheaper alternatives for entertainment. Small changes can add up to significant savings over time.

6. Save on Housing

Housing is often one of the most significant expenses for young adults. Consider sharing an apartment with roommates to split the costs, or if you have extra space, consider renting it out for some additional income. Cutting down on housing expenses can free up more money for savings.

7. Take Advantage of Workplace Benefits

Many employers offer retirement savings plans or matching contributions. Take full advantage of these benefits as they can significantly boost your savings over time. Contribute the maximum amount that your employer matches to make the most out of this opportunity.

By following these savings tips, millennials and Gen Z can develop healthy financial habits and build a solid foundation for their future. Remember, saving is a long-term commitment, and every small step counts!