Estate Planning: A Comprehensive Guide

When it comes to managing your assets and ensuring their smooth transfer to your loved ones after your passing, estate planning plays a crucial role. Understanding the basics of estate planning is essential for everyone, regardless of their financial status or age.

What is Estate Planning?

Estate planning refers to the process of making decisions about how your assets will be managed, preserved, and distributed after your death. It involves creating legally binding documents, such as wills, trusts, and powers of attorney, to ensure that your wishes are carried out.

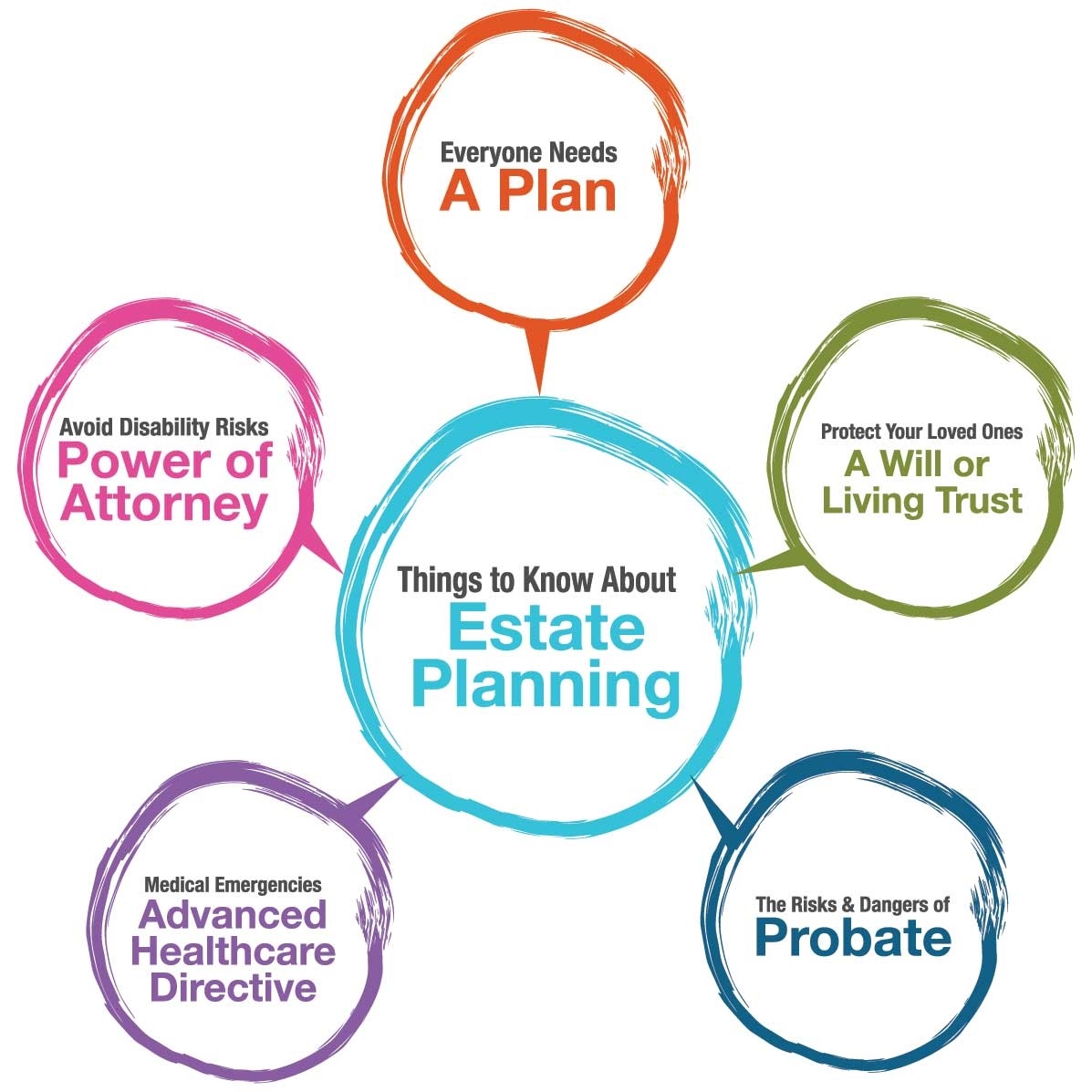

Key Components of Estate Planning

1. Last Will and Testament: A will is a legal document that outlines your wishes regarding the distribution of your assets, appointment of guardians for minor children, and other important matters.

2. Trusts: Trusts allow you to transfer your assets to a trustee, who will manage and distribute them according to your instructions. Trusts can help minimize estate taxes and provide ongoing financial support for beneficiaries.

3. Power of Attorney: This document grants someone the authority to act on your behalf in legal, financial, and healthcare matters if you become incapacitated.

4. Beneficiary Designations: Review and update beneficiary designations on retirement accounts, life insurance policies, and other assets to ensure they align with your estate planning goals.

Why is Estate Planning Important?

1. Asset Distribution: Estate planning allows you to determine how your assets will be distributed, ensuring your loved ones are taken care of and your wishes are respected.

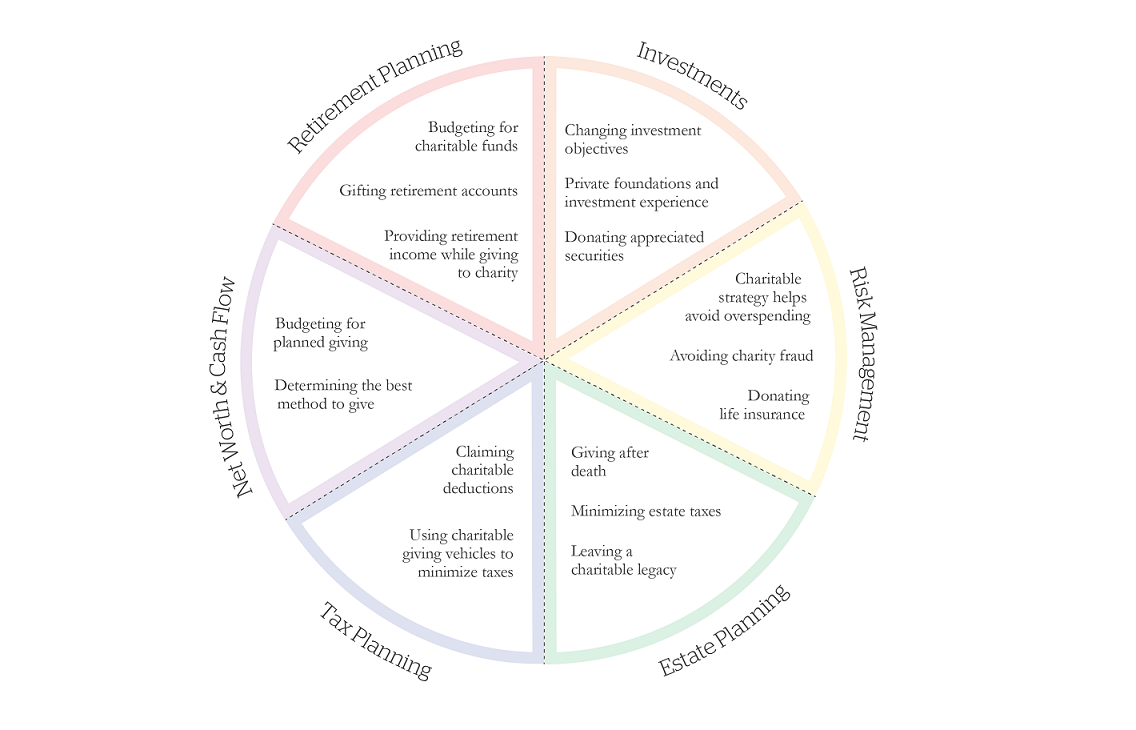

2. Minimizing Taxes: Proper estate planning can help minimize estate taxes, allowing you to pass on more of your wealth to your beneficiaries.

3. Avoiding Probate: Through various estate planning tools, such as trusts, you can potentially avoid the lengthy and costly probate process.

4. Incapacity Planning: Estate planning also includes provisions for managing your assets and healthcare decisions in the event you become incapacitated.

Conclusion

Estate planning is a critical process that ensures your assets are distributed according to your wishes, minimizes taxes, avoids probate, and provides for incapacity planning. By understanding the basics of estate planning and seeking professional guidance, you can secure your financial legacy and provide for your loved ones.