Building a Diverse Investment Portfolio

Investing is an essential part of building wealth and securing your financial future. However, it is crucial to understand that investing comes with risks. One way to mitigate these risks is by building a diverse investment portfolio.

The Importance of Diversification

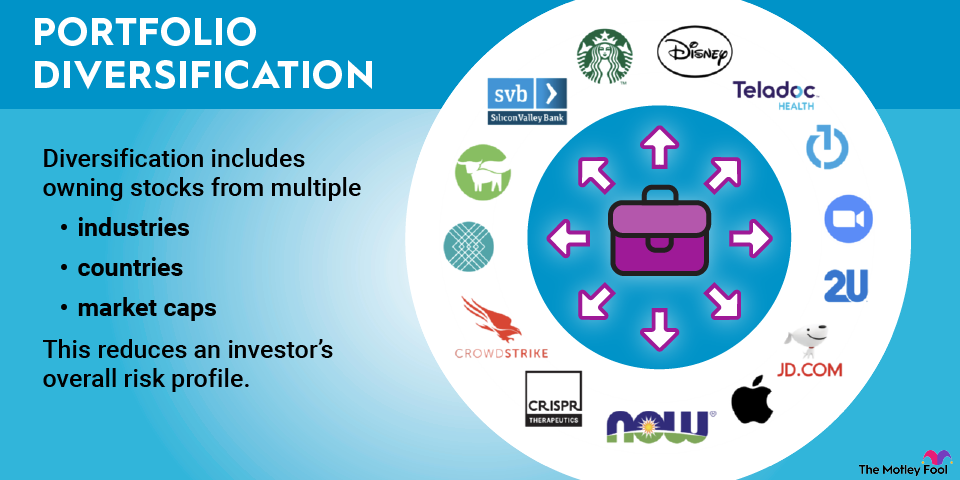

Diversification is the practice of spreading your investments across different asset classes and industries. By doing so, you can reduce the impact of any single investment’s performance on your overall portfolio. Diversification helps protect your investments from market volatility and potential losses.

When building a diverse investment portfolio, it is essential to consider various asset classes such as stocks, bonds, real estate, and commodities. Each asset class has its own unique risk and return characteristics, and by investing in a mix of these assets, you can potentially achieve a balance between growth and stability.

Strategies for Building a Diverse Portfolio

Here are some strategies to consider when building a diverse investment portfolio:

1. Asset Allocation: Determine the percentage of your portfolio to allocate to different asset classes based on your risk tolerance and investment goals. This will help ensure that your investments are spread across various categories.

2. Sector Allocation: Within each asset class, diversify further by investing in different sectors. For example, if you invest in stocks, consider allocating funds to sectors like technology, healthcare, and finance.

3. Geographic Diversification: Invest in companies and assets across different countries and regions. This can help reduce the impact of any single country’s economic performance on your portfolio.

4. Rebalance Regularly: As market conditions change, some investments may perform better than others. Rebalancing your portfolio periodically ensures that your asset allocation remains in line with your desired risk profile.

The Benefits of a Diverse Portfolio

A diverse investment portfolio offers several benefits:

1. Risk Management: Diversification helps reduce the risk associated with any single investment. If one investment performs poorly, others may balance it out, minimizing potential losses.

2. Potential for Higher Returns: By investing in different asset classes, you are exposed to a broader range of opportunities. This increases the potential for higher returns compared to relying on a single investment.

3. Stability: A diverse portfolio can provide stability during market fluctuations. If one asset class is underperforming, others may be performing well, balancing out the overall portfolio’s performance.

In conclusion, building a diverse investment portfolio is essential for managing risk and maximizing returns. By spreading your investments across various asset classes, sectors, and geographic regions, you can enhance the stability and potential growth of your portfolio.