Budgeting Basics: A Guide to Financial Success

In today’s fast-paced world, managing your finances effectively is crucial. Budgeting is the foundation of financial success, allowing you to allocate your income wisely and prioritize your expenses. By following some budgeting basics, you can gain control over your money and work towards achieving your financial goals.

1. Track Your Expenses

The first step in budgeting is to track your expenses. Keep a record of everything you spend, whether it’s through a mobile app, spreadsheet, or a simple pen and paper. By understanding where your money is going, you can identify areas where you can cut back and save.

2. Set Financial Goals

Establishing clear financial goals is essential for successful budgeting. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having specific objectives helps you stay focused and motivated. Break down your goals into smaller milestones, making them more achievable and realistic.

3. Create a Realistic Budget

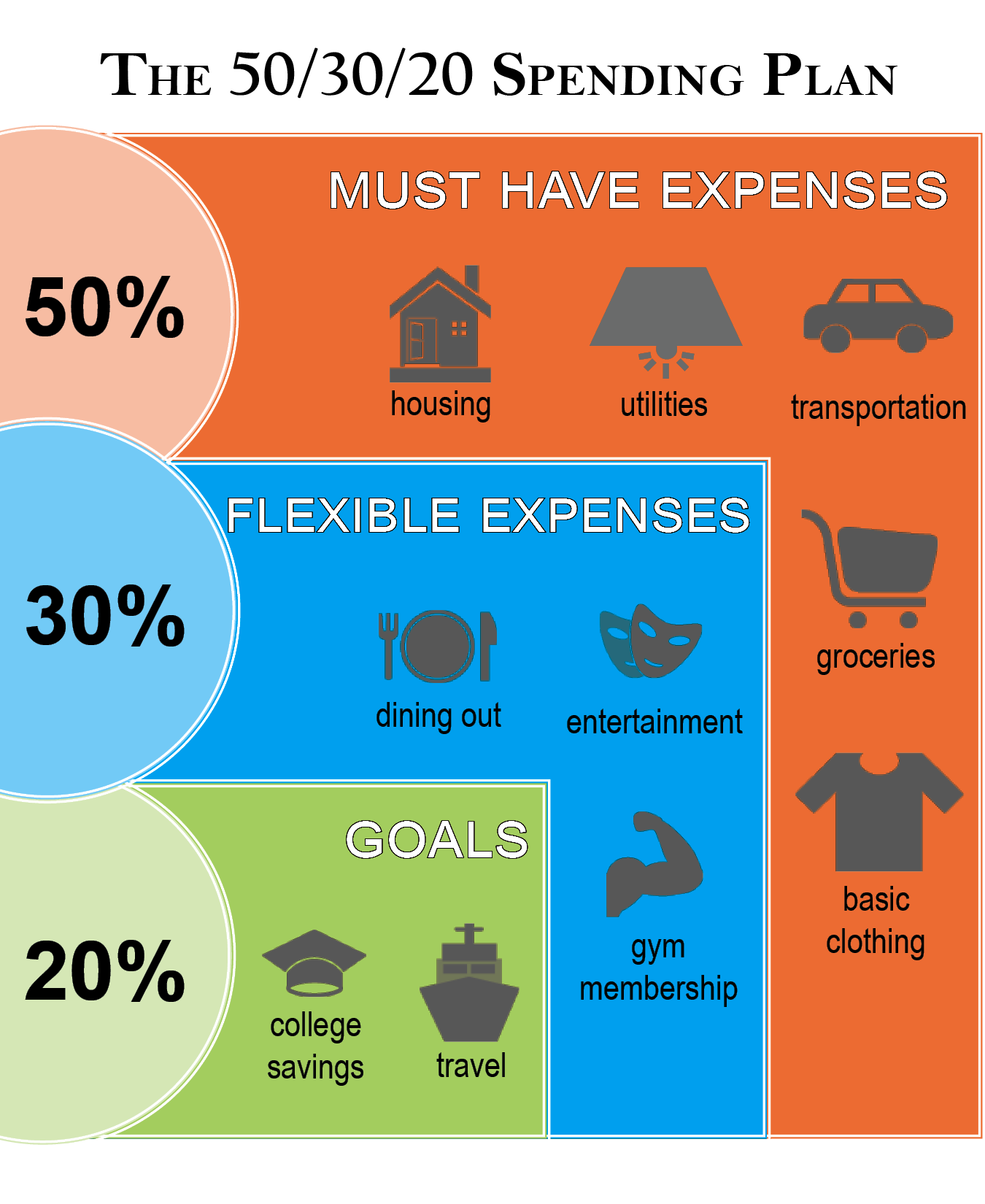

Based on your income and expenses, create a budget that works for you. Allocate a certain percentage of your income towards necessities such as housing, utilities, and groceries. Set aside a portion for savings and investments, and allow yourself some room for discretionary spending. Be realistic and flexible with your budget, adjusting it as needed.

4. Prioritize Debt Repayment

If you have any outstanding debts, make it a priority to pay them off as soon as possible. High-interest debts, such as credit card balances, can quickly accumulate and become a financial burden. Allocate a portion of your budget towards debt repayment, focusing on one debt at a time while making minimum payments on others.

5. Save for the Future

Building an emergency fund and saving for retirement are crucial aspects of budgeting. Set aside a portion of your income for unexpected expenses and establish an automatic contribution towards your retirement account. Start saving early, as even small amounts can grow significantly over time.

6. Review and Adjust Regularly

Regularly review your budget and track your progress towards your financial goals. Make adjustments as necessary, especially when your income or expenses change. Stay disciplined and avoid unnecessary spending, but also allow yourself some room for enjoyment and splurges.

By following these budgeting basics, you can gain control over your finances and work towards achieving financial success. Remember, budgeting is a continuous process that requires discipline and commitment. Start today and pave the way for a secure financial future.