Understanding Taxes: A Guide to Financial Responsibility

Taxes play a crucial role in the functioning of any society. They are the primary source of revenue for governments, enabling them to provide essential services and fund public infrastructure. While taxes are an integral part of our lives, many individuals find them confusing and overwhelming. This article aims to demystify taxes and provide a better understanding of their significance.

Types of Taxes

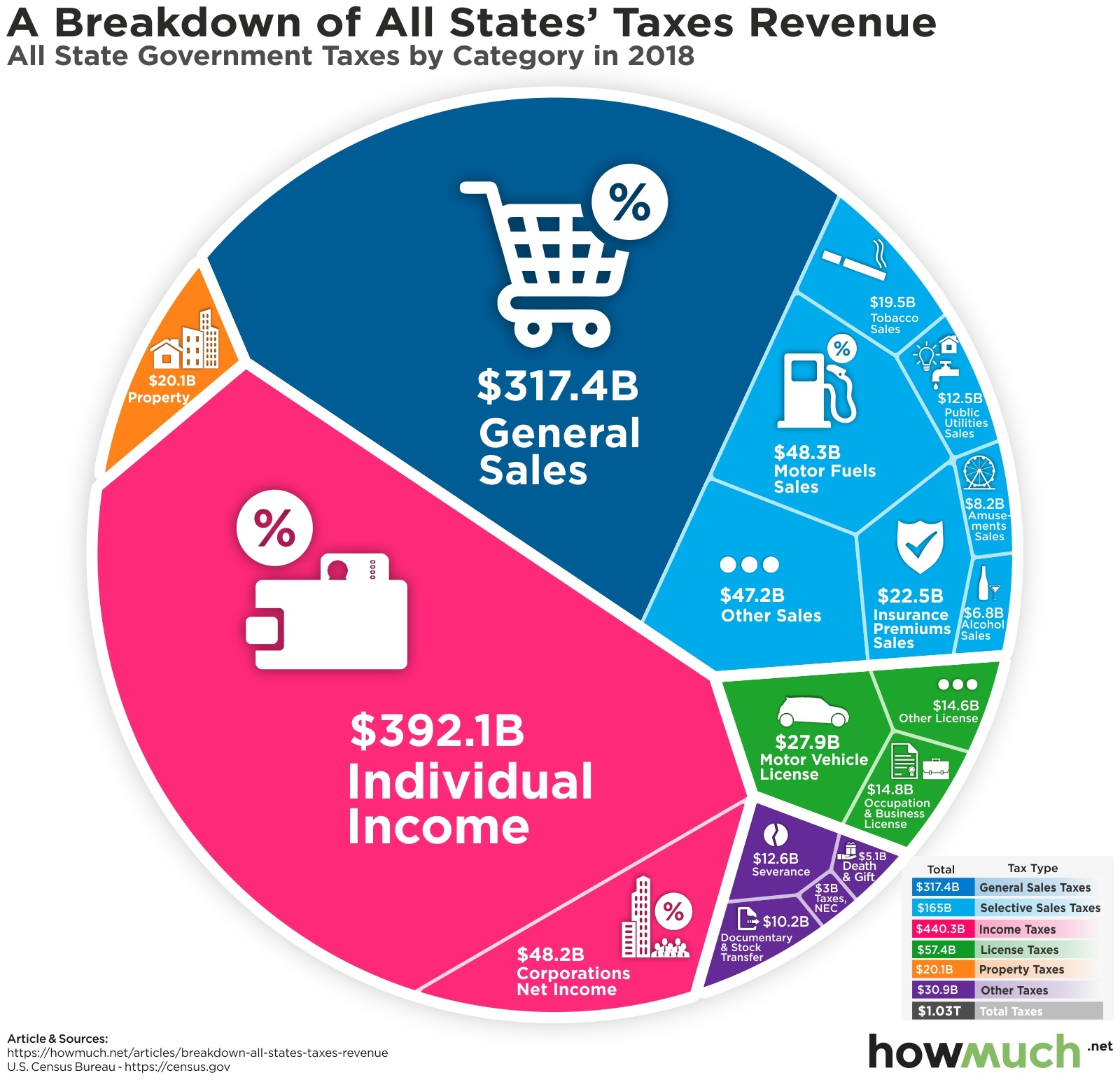

There are various types of taxes, including income tax, sales tax, property tax, and corporate tax. Income tax is levied on an individual’s earnings, while sales tax is imposed on goods and services purchased. Property tax is based on the value of real estate owned, and corporate tax is applicable to businesses’ profits.

Understanding the different types of taxes is essential to ensure compliance and avoid any legal consequences. It is crucial to familiarize yourself with the tax laws applicable to your specific circumstances.

Taxation Process

The taxation process involves several steps. First, individuals or businesses must determine their taxable income or revenue. This is done by calculating the total income and deducting any eligible expenses or deductions. The resulting amount is known as taxable income.

Next, the tax rates applicable to the taxable income are determined. Different jurisdictions have varying tax brackets and rates. Individuals or businesses then calculate the tax owed by multiplying the taxable income by the applicable tax rate.

Finally, the tax owed must be paid to the government within the specified deadline. Failure to comply with tax payment obligations can lead to penalties and legal consequences.

Importance of Paying Taxes

Paying taxes is not only a legal obligation but also a civic duty. Taxes fund public goods and services that benefit society as a whole. These include healthcare, education, infrastructure development, and social welfare programs. Without taxes, governments would struggle to provide these essential services.

Additionally, taxes contribute to economic stability and growth. They enable governments to invest in public infrastructure projects, create job opportunities, and stimulate economic development. Through various tax incentives and credits, governments also encourage specific activities such as research and development or renewable energy adoption.

Conclusion

Understanding taxes is crucial for financial responsibility and compliance with legal obligations. By familiarizing ourselves with the different types of taxes, the taxation process, and the importance of paying taxes, we can navigate the complex world of taxation more confidently. Remember, taxes are a vital part of our society, enabling governments to provide essential services and contribute to overall economic growth.