Understanding Credit Scores

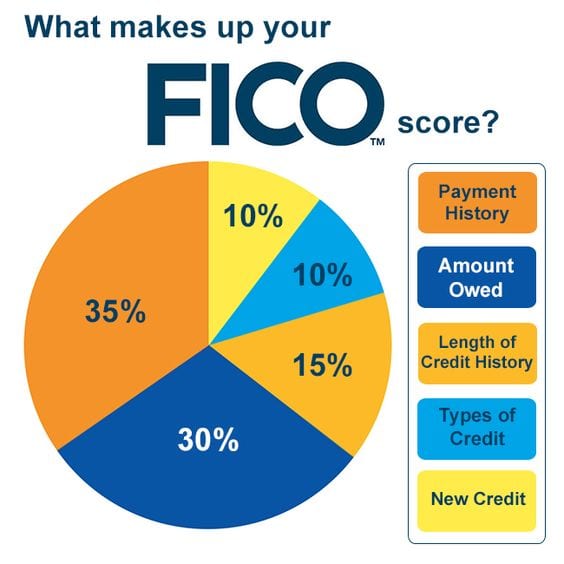

A credit score is a three-digit number that represents an individual’s creditworthiness. It is an important factor considered by lenders when determining whether to approve a loan or credit application. While the exact calculation may vary depending on the credit bureau, the main components that influence a credit score are payment history, credit utilization, length of credit history, types of credit used, and new credit.

The Importance of Credit Scores

Credit scores are crucial because they provide lenders with an objective measure of a person’s financial responsibility. A higher credit score indicates a lower risk for lenders, making it easier to secure loans and credit at favorable terms. On the other hand, a low credit score can result in higher interest rates, limited borrowing options, and difficulty obtaining credit.

Understanding the factors that affect credit scores can help individuals take steps to improve their creditworthiness. It is essential to make timely payments, keep credit utilization low, maintain a long credit history, diversify credit types, and avoid applying for too much new credit at once.

Monitoring and Managing Credit Scores

Regularly monitoring credit scores is crucial to detect errors or signs of identity theft. By obtaining free annual credit reports from each of the three major credit bureaus, individuals can review their credit history and ensure its accuracy. If any inaccuracies are found, they should be promptly disputed and corrected.

Additionally, there are several online tools and services that provide credit monitoring and alerts for changes in credit scores. These services can help individuals stay on top of their credit health and take action if their scores decrease.

Conclusion

Understanding credit scores is vital for individuals who want to make informed financial decisions. By maintaining a good credit score, individuals can access better loan and credit options, potentially saving thousands of dollars in interest payments. Regularly monitoring and managing credit scores can help individuals maintain a healthy credit profile and protect themselves from identity theft or errors in their credit reports. It is essential to educate oneself about credit scores and take proactive steps to improve and maintain a good credit standing.